A state of stagnation

As reported in the Q3 2024 PitchBook NVCA Venture Monitor, interest rates fell by 50 basis points, and venture capital activity in the third quarter didn’t twitch. While fundraising and dealmaking didn’t fall, per se, they haven’t recovered, either—largely because exits remain flat. The persistently subdued results have left the industry in a prolonged stalemate. Without distributions, LPs aren’t eager to contribute more capital to the asset class. With fundraising in the doldrums, GPs don’t want to invest in new deals—with the exception of AI—that require them to call capital from the very LPs for whom they have not generated returns.

It’s a recipe for industry-wide stagnation.

Fundraising: Bigger is better (and that’s about it)

At $65.1 billion, VC fundraising totals through Q3 2024 are on track to finish the year roughly tied with 2023’s. But the annualized fund count of 506 is the lowest since 2014’s total of 497. This skewed distribution reflects the flight to established firms raising large funds.

PitchBook reports that 81% of capital raised has gone to established firms, usually raising large (over $500 million) funds. Such an extreme concentration of fundraising among established managers was last seen in 2008.

Pitchbook data also shows that time in the market has extended dramatically, hitting records for both median (14.7 months) and average (17.0 months).

Many VC GPs have postponed their fundraising efforts until 2025 in hopes of a recovery in LP demand. But additional analysis by PitchBook noted that the number of unique VC investors—those that have made at least one VC investment in the U.S. this year—has fallen. If the trend continues, 2024’s total number will end up roughly matching 2023’s at 15,303, which itself was some 10,000 below 2021’s peak.

Earlier this year, 13% of GPs said they had abandoned hopes of raising a new fund. This turned them into “zombies,” managing out the existing portfolio and continuing to take fees while doing so but not making new investments.

In talking to other experts on the cutting edge of VC fundraises, the Juniper Square team is hearing renewed hope that the industry is experiencing the early green shoots of recovery. We would expect the closes of these funds to show up increasingly in Q1 and Q2 next year, even if Q4 remains slow. LPs need a strong line of sight to exits to make commitments, but those exits don’t necessarily need to be fully processed to give the LPs confidence to make commitments for the next four years.

Exits: Hoping for IPOs

According to PitchBook, the quarter’s exit value of $10.4 billion marked a five-quarter low, reflecting the lack of large IPOs. However, the estimated count, 938, when annualized, would exceed 2023’s level and place sixth in the decade. While GPs have become creative with continuation funds and secondaries in their attempts to provide some measure of liquidity, LPs are not unmitigated fans of either strategy.

Other exit strategies have included acquisitions by buyout firms, which may purchase VC-backed start-ups as add-ons or net new platforms. Research has shown this strategy can strengthen portfolio companies when the cycle recovers. Corporate strategic acquisitions, though, remain suppressed by two forces. One is the threat of regulatory scrutiny; the other is the high valuations stemming from the frothy market in the early 2020s. The new FTC regulations approved on Oct. 15 seem likely to further complicate mergers as well.

Through the end of Q1 2024, though, PitchBook data showed that net cash flows to LPs (distributions minus capital called) had moved into positive territory for the first time since 2021 due to increased distributions and severely reduced capital calls. Whether this trend persists, however, is uncertain. On the last day of the quarter, AI chip maker Cerebras Systems registered for an IPO, representing the first hope for a big tech exit since April. More companies are signaling an openness to filing early next year as interest rates (hopefully) fall and investors increasingly shift back to a risk-on mindset.

Deals: Unless you’re AI or ML, the rounds are flat or down

While fundraising is down, deal activity is flat. This is not surprising, as fundraising tends to lag behind performance. Venture capitalists are focusing on “quality over quantity” in their deals, as PitchBook said.

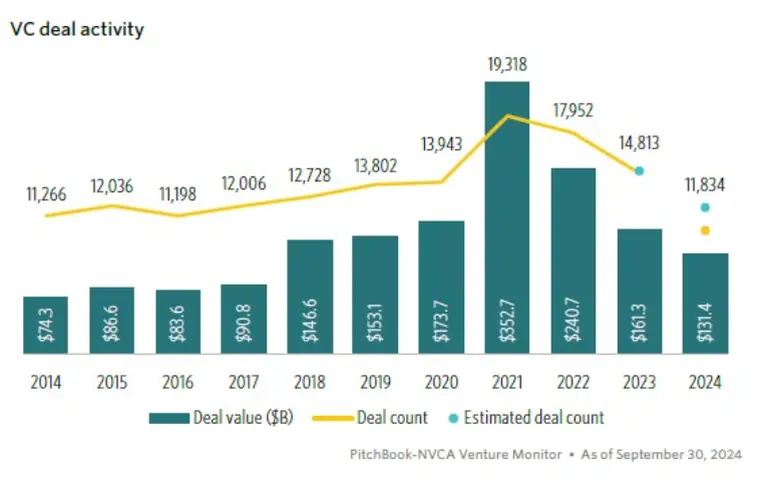

Deal value for the year-to-date reached $131.4 billion, which annualizes to $175 billion. This would place 2024 third in the decade, behind only 2021 and 2022. The annualized deal count, though, seems likely to match 2023’s total, suggesting that mega-deals in the AI and machine learning (ML) space are driving deal values up.

For those companies that are not hot AI/ML startups, flat and down rounds are the price of survival. Some of the deal activity—28.4%, according to PitchBook analysis—has been associated with valuation cuts as companies finally reach the end of their runway. Less obvious are the rounds that are “up” in name only, where onerous terms, such as liquidity preferences or anti-dilution stipulations, mean that the value of the company has fallen in all but the most optimistic exit scenario.

Conclusion

It’s been a long way to fall since the heady days of zero-interest-rate policy (ZIRP). But VC is a cyclical business, and it’s gone through booms and busts in the past. The VCs who clean up their portfolios, cut their losses, and focus on the strongest companies will recover faster and be able to pick up companies that are lean and well-priced. Those GPs who cling to outdated valuations will end up as zombies, shrunken and irrelevant.