Published March 14, 2023

As the universal store of partnership information for more than 1,800 GPs, Juniper Square has the unparalleled ability to get a true, under-the-hood look at the private CRE market. Using aggregated and anonymized client data, our Market Pulse report shares key insights into transaction volumes, allocations by property type, state-level purchase volume, and more.

Let’s get started.

Transaction volume growth since 2020

The pandemic created divergences by property type

This chart represents the percent change in transaction volumes by property type when comparing Jan-Dec of 2020 to the same time period in 2022.

Private CRE transaction volume–measured in gross purchase costs of assets acquired–had steadily increased for a decade before the COVID pandemic. Between 2020 and 2022, we saw wide divergences in transaction volume by property type.

- Excluding office and hotel, transaction volumes have grown 4%. Inclusive of office and hotel, transaction volumes declined 44%.

- Multifamily transaction volumes dropped by 14%, while office declined by 87%.

- Industrial transaction volumes increased 70%, and 2022 was the 2nd highest year on record for industrial.

Transaction volume growth over the past decade

Industrial sees continued strength while retail rebounds

This chart shows the 2-year moving average change in transaction volume by property type.

When looking at transaction volume growth smoothed over time, trends by property type become even clearer.

- Industrial has shown consistent gains for over a decade, with a notable acceleration in growth during the pandemic as demand for e-commerce surged.

- As the economy reopened and consumers returned to in-person shopping, retail volumes have started to rebound after a dip during the pandemic.

- Multifamily has seen strong gains over the past decade, while office moved from decelerating growth to outright decline since 2020.

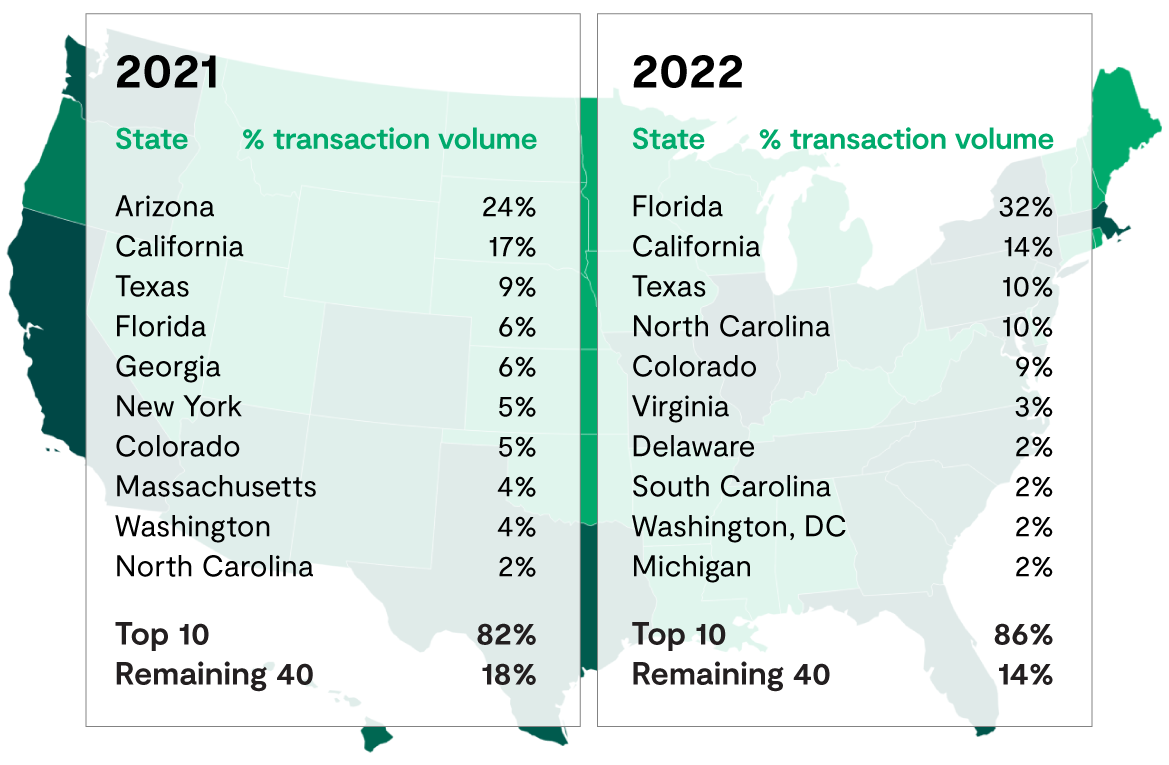

State-level transaction volume

Florida emerged as a leader by volume, while Arizona fell out of the top 10

This table chart compares the top ten states by transaction volume in 2021 and 2022.

When viewing transaction volumes by state, we see a shift in where owners and operators looked to do business year-over-year.

- Florida captured approximately 32% share, five times that of the prior year.

- Formerly hot markets such as Arizona, Georgia, and New York saw their share fall outside of the top 10.

- Texas held onto 3rd place, while North Carolina jumped from 10th to 4th.

Share of acquisitions by property type

Multifamily dominates, while industrial’s share is rising

This pie chart shows the percentage of allocations by property type acquired between 2013 and 2022.

When we look at the share of acquisitions–measured by the number of assets–across property types, we see the impact of the above trends from a different perspective.

- Multifamily remains the largest in terms of volume, with its share of acquisitions remaining between 43% and 48% for the past decade.

- Industrial acquisitions have risen as a share of the total from less than 7% in 2018 to nearly 18% in 2022.

- Office acquisitions have seen the biggest decline over that same period, from a share of 24% in 2018 down to just 16.5% in 2022.

Acquisitions by risk profile

A shift away from value-add

This bar chart compares the percentage of acquisitions by risk profile from 2021 to 2022 based on total deal counts.

2022 saw a marked shift in the types of acquisitions GPs found attractive–when measured as a percentage of acquisitions by risk profile.

- The share of value-add deals dropped by more than 16%.

- The share of acquisitions for core plus saw the biggest jump, 7% overall.

Funds by risk profile

Value-add funds remain dominant

This bar chart shows the percentage of new funds organized by risk profile launched in 2022 compared to 2021.

When looking at investor preferences–measured by the percentage of new funds by risk profile–it's clear that demand for value-add funds remains high, while the appetite for opportunistic funds decreased considerably.

- Value-add funds’ share rose from 48% to 52% of all funds launched.

- Opportunistic funds had the largest drop in share, decreasing by 14%.

- The share of core plus funds grew by 11%.

Loan-to-value ratios

LTV ratios leveled out over time

This graph plots fund loan-to-value (LTV) ratios from December 2019 through December 2022.

After peaking at 59% in June 2021, LTV ratios remained nominally flat through the second half of 2022, ending the year marginally below 2019 ratios.

Fixed vs. floating rate loans

GPs rely more on floating interest rate loans

The line graph illustrates the count of fixed versus floating interest rate loans over time.

Over the years, more GPs have taken out more floating interest rate loans to help fund their projects. The gap between fixed and floating started widening back in 2018.

Comparable performance across public and private investments

Private real estate delivers non-correlated returns over time

This chart compares the total returns to the end of Q4 2022 of several private and public asset classes over the last ten years.

The National Council of Real Estate Investment Fiduciaries (NCREIF) Fund Index – Open End Diversified Core Equity (ODCE) is a quarterly benchmark of private real estate returns. When compared to the equity returns of publicly-traded REITs and broad stock market indexes, it’s evident that private real estate can deliver non-correlated returns and help diversify an investor’s portfolio.

Conclusion

The CRE industry grew massively over the last decade–total transaction volumes were up 250% from 2012 to 2018, the biggest year on record. For many individual property types, 2020 or 2021 were their best years yet.

Even when faced with multiple headwinds in 2022–ongoing supply chain disruptions, rising inflation, and interest rate hikes–the overall resiliency of CRE was on display. Retail is bouncing back. Industrial is booming. GPs are still sourcing deals, developing projects, launching funds, and raising capital from LPs across the country.